Finally, the results are up! I passed the CAIA Level II Exam !!

It all started at the 69th CFA Annual Conference in Montréal back in 2016. I met William Kelly (President and CEO of CAIA Association) and he encouraged me to pursue the CAIA Program. I played with the idea for some time and finally, CAIA Institute launched the Stackable Program for CFA Charterholders. Among other things, the CAIA Level I Exam was waived. This was the sign I was waiting for! I couldn’t resist the opportunity, it was too good to miss!

First, Why I did it?

After going through the CFA Program in 2011, I thought that was it, no more exams for me! But, as you can imagine, our industry is always evolving and new products, strategies, and regulations come into place. The Alternative Investments industry is growing in Mexico and the CAIA Charter is recognized by the Mexican pensions regulator, CONSAR. Also, being a global Charter, I am confident it will improve my chances of landing a job elsewhere (my objective: Canada).

CAIA Level II Exam Contents

These were the most interesting subjects:

Hedge Funds and Managed Futures

- Managed Futures, CTAs

- Relative Value Strategies, convertible arbitrage

- Hedge Funds – vs. Directional and Credit Strategies

- Volatility, Correlation, and Dispersion Products and Strategies

- Hedge Fund Replication

- Funds of Hedge Funds and Multistrategy Funds

- Hedge Fund Operational Due Diligence

Institutional Investors

- Asset Allocation Processes and the Mean-Variance Model

- Tactical Asset Allocation, Mean-Variance Extensions, Risk Budgeting, Risk Parity, and Factor Investing

- The Endowment Model, Sovereign Wealth Funds and Family Offices, Pension Funds

The material covered also Private Equity, Real Assets, Intellectual Property (how to invest in Art and Movies, interesting), Structured Products, Commodities. Among the current readings, Blockchain was a good introduction to Cryptocurrencies and the associated tech. These readings help the CAIA Level II Curriculum to be at the edge of trends.

Now, here is how I prepared:

Time spent

The whole curriculum and readings were 1,200 pages long, in total. Considering my reading speed of 5 pages/hr (including taking personal notes), I spent a total of 240 hrs in the material. Relative to each CFA Exam which are 3,000 pages each and took me 300-350 hrs to study, this time it was a slower pace. Maybe it was that some concepts were new to me, or maybe I got rusty over the years. One thing that bothered me from time to time was: “as we saw in the CAIA Level I book”, “the basics were covered in Level I”. It made me wonder if I had the right background knowledge for the exam.

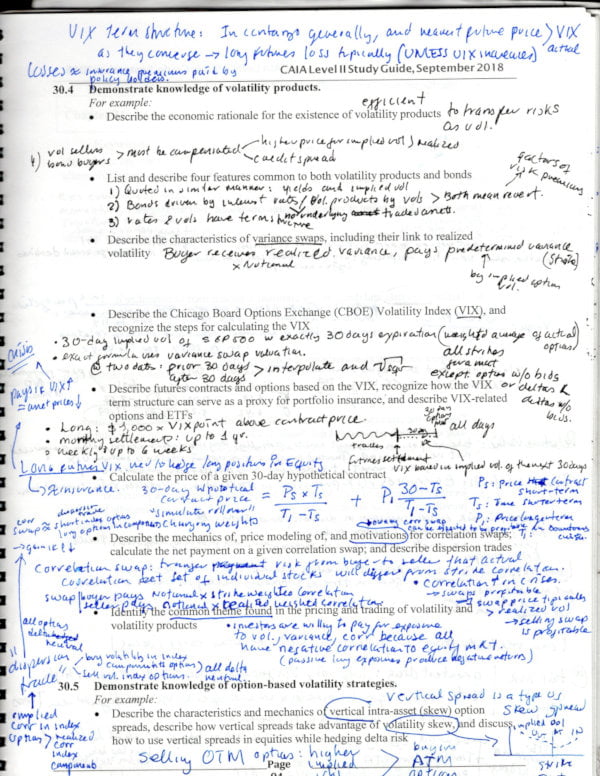

Notes. Many handwritten notes.

As usual, I used the LOS to print a notebook, with enough spacing for notes. I am a visual person and writing and drawing help me remember easier.

CAIA Level II Notes

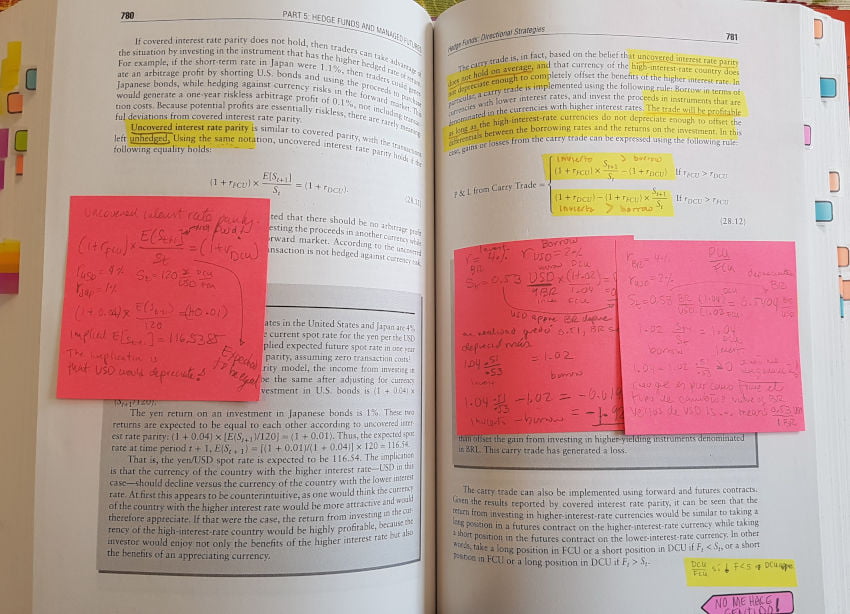

I don’t like writing on books so this time I used highlighting tape and LOTS of post-it notes. Exercises were in the post-its, so it was easy at the end to take them all and paste them for review.

Highlighting and notes

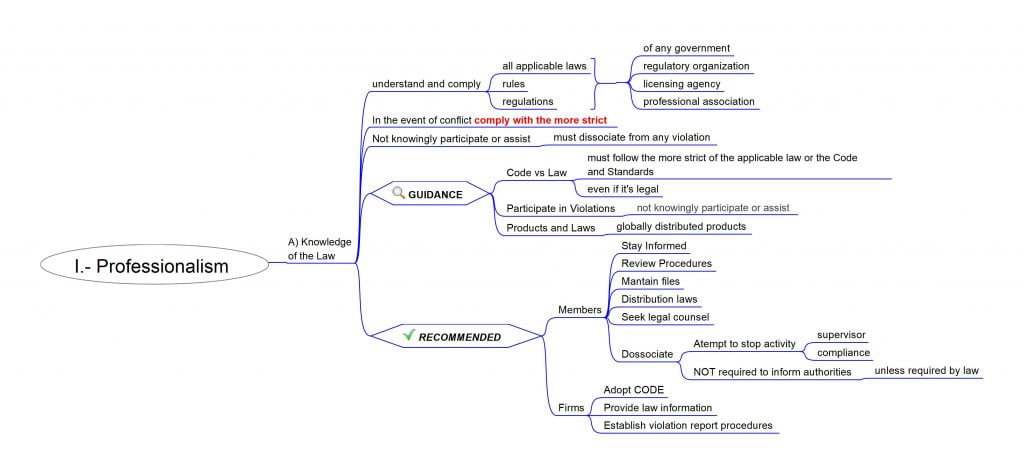

Also, I recycled my Ethics mindmaps I used to prep for my CIPM Exam:

CIPM Ethics MindMap

Recordings for the Road

Every day my commute is around 2.5 hrs (I know, It sucks!). So I decided to try something new and seize this time: voice notes. I took my notes and started recording them with my phone. Very basic and nothing fancy. Each chapter was 20-30 min long, so I could listen to four to five chapters every day. Heres a short soundbite of Chapter 8: Private Equity Benchmarks (Spanglish):

This method helped me first to organize my thoughts and trying to figure out my notes. Also, reading out loud is an excellent way to review, as visual and listening learning is combined.

(Not enough) practice exercises.

Mock exam: I did the mock exam included with the exam fee. It helped me realize that my weak spot was the formulas. But, my time was running out and I couldn’t do many exercises from the CAIA Workbook. Ex-post, I realize it was a good material that I didn’t take advantage from.

What about the Exam?

As you may know, CAIA regulations don’t allow for exam content disclosure. But, I can say that It was fair, straightforward, based on the material and a little bit easier than a CFA Exam. The second section is open questions and at first, I thought 60 minutes were more than enough to complete. But in the end, Ethics questions were more difficult than what I had in mind, made me go over and over my answers, several times, so I just finished within the allotted time.

Something I missed from the results email was the overall performance. I was used to getting a subject by subject performance percentile in CFA Exams. With CAIA, I don’t really know how well I performed in each section.

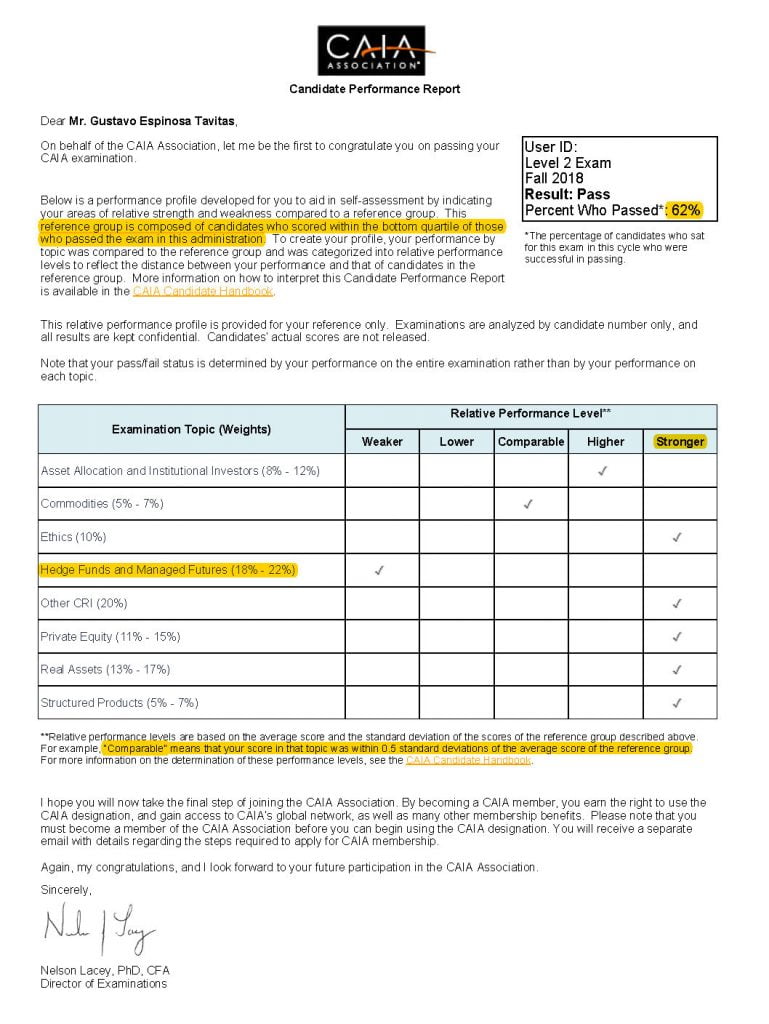

Now I found my performance results at my CAIA Member website. Actual scores are not released. 62% of candidates of the Fall 2018 CAIA Level II exam passed. Performance is compared to the lower quartile of those passing candidates and reported in categories. For each topic, my relative performance was determined by comparing my performance (my Candidate Score, or CS) to the average score of the reference group (x), and the standard deviation of the scores of the reference group (σ). For example, a “comparable” results can be interpreted as x – 0.5×σ < CS ≤ x + 0.5×σ and Stronger means my was one and a half standard deviation above the comparison group mean, CS > x + 1.5×σ.

My performance in Hedge Funds was way below the average relative to the lowest quartile of passing candidates. I knew this was the topic with more weight, so I this was the first one I read, back in June. For all other topics, I was surprised I was above the average.

CAIA Candidate Performance Report

Thanks and Acknowledgments

First, thanks to my family, Rosy, and Diego, who each time I get enrolled in some certification they support me. It’s not easy for the family, as most of my free time goes to prep. Secondly, thanks to all my CFA Charterholder colleagues (Sameer S, Alex H, Javier D) who also hold the CAIA and gave good advice and tips. I’d also like to thank the CAIA Association for letting me participate in this pilot Stackable Program for CFA Charterholders.